child tax credit 2021 eligibility

In the tax year 2021 under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6. For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit.

The Big Increase And More Changes To The Child Tax Credit In 2021 Gobankingrates

This letter from the IRS aims to help taxpayers compare and receive this child tax credit.

. Married couples filing a joint return with income of 150000 or less. It should be kept with their tax records. Children also must have a Social Security number SSN to qualify for the 2021 child tax credit.

Have child with a valid social security number who was under age 18 at the end of 2021. Parents with children aged 5 and younger can qualify for a 300 monthly child and dependent care credit while older children aged 6-17 years old will be given a 250 monthly payment. The new advance Child Tax Credit is based on your previously filed tax return.

The monthly advance Child Tax Credit payments were as much as 300 for each child under six and 250 for each child six and older. As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

Families with a single parent also called Head of Household with income of 112500 or less. The payment for children. The maximum Child Tax Credit payment was 3600 for each qualifying child up to age 5 and 3000 for each child age 6-17.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. The phase-out threshold was increased from 75000 to 200000 for single filers and from 110000 to 400000 for those filing jointly. 2021 Child Tax Credits eligibility.

The taxable income threshold has increased to 150000 there is no longer a maximum credit limitation the credit percentage increased for thousands of taxpayers and eligible claimants can receive a refund of the credit after any tax is paid. Ad File a free federal return now to claim your child tax credit. Non-child dependents are now worth 500 in tax credits.

Not everyone is eligible for advance child tax credit payments. Parents must have an earned income of at least 2500. States Government English Español中文 한국어РусскийTiếng ViệtKreyòl ayisyen Information Menu Help News Charities Nonprofits Tax Pros Search Toggle search Help Menu Mobile Help Menu Toggle menu Main navigation mobile File Overview INFORMATION FOR Individuals Business Self Employed.

MILLIONS of Americans are set to get their final monthly child tax credit payment in December under President Joe Bidens American Rescue Plan. Be within the income limits. How much is the child tax credit worth.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17. To be eligible you and your spouse if filing jointly must. This is the first year that 17-year-olds qualify for the CTC the previous age limit was 16.

All children must possess a Social Security Number. Half of the total amount came as six monthly payments so for each child up to age 5 you would have received six payments of up to 300 and for each child age 6-17 you would have received six monthly payments of up to 250. Have filed a 2019 or 2020 tax return.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit. Half of the money -- up to 300 per month per child -- was distributed to eligible families who didnt opt out using the IRS Child Tax Credit Portal in 2021. The American Rescue Plan expanded the child tax credit from 2000 per child taken every year when you file your taxes to 3600 per child with half the amount paid in monthly installments.

Who Is Eligible for the Advance Child Tax Credit. They will be sent out from July to December and the rest will be claimed on your tax return for 2021. The monthly tax credits will be.

The remaining half of the credit for e ligible may be claim ed when the advanced payments are reconciled with the total eligible Child Tax Credit on the 2021 income tax return. The purpose of the bill which was signed by B. Before 2021 the credit was worth up to 2000 per eligible child and children 17 years and older were not eligible for the credit.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Up to 8000 for two or more qualifying people who need care up from 2100 before 2021. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Since the 2021 credit is fully refundable youll get a tax refund if the credit amount you claim on your return is greater than your tax liability. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. Parents with children aged 17 years or under are mostly eligible for the new child tax credit.

It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. Beginning with Tax Year 2021 amendments to the law were made to help benefit even more New Jerseyans. As a result every dollar you can claim as a child tax credit on your tax return is subtracted from the tax you owe.

Letter 6419 was sent to eligible taxpayers and included information about the 2021 advance child tax credit payments along with the number of qualifying children used to calculate the total amount. Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021. Most families with children 17 and.

Your amount changes based on the age of your children.

8812 Ctc Actc And Odc Faqs Drake18 Drake20

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Child Tax Credit 2021 8 Things You Need To Know District Capital

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit Children 18 And Older Not Eligible 13newsnow Com

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

What Families Need To Know About The Ctc In 2022 Clasp

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Arpa Expands Tax Credits For Families

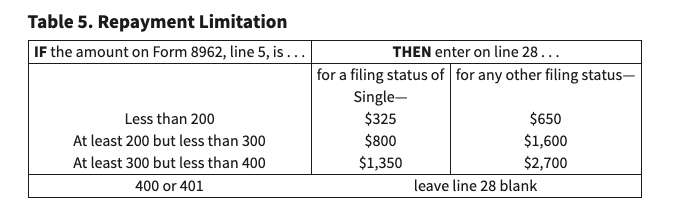

Advanced Tax Credit Repayment Limits

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Did Your Advance Child Tax Credit Payment End Or Change Tas

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2021 8 Things You Need To Know District Capital