crypto tax accountant ireland

Besides being a crypto enthusiast he is also a passionate gamer and can be found in Orgrimmar when not at his desk. We are not a registered accountant and do not know your individual circumstances so cannot provide individual tax advice if you are in doubt consult a tax professional.

2022 State Of Accounting Firms Trends Report

All companies listed here are well versed with cryptocurrency trading.

. This is the directory of crypto accountants CPAs and tax professionals. Koinly helps you calculate your capital gains for both periods in accordance with Revenue Commissionerss guidelines ie. You bought 1000 worth of Bitcoin and sold it for 3000 later on.

Realising a gain on Cryptocurrency investments. Richard has traded across different exchanges for several years and understands just how complicated Cryptocurrency Taxation can appear. File your crypto taxes in Ireland Learn how to calculate and file your taxes if you live in Ireland.

The module part of the FAE assessment will give newly trained accountants exposure to both. Liam is a member of the Association of Chartered Certified Accountants and is a a Chartered Tax Adviser with the Irish Taxation Institute. If the mining activity does not amount to a viable trade considering end of year profits and.

Crypto mining activities on the other hand individual or corporate will likely be regarded as trading - making crypto mining profits subject to income taxcorporation tax not CGT. Youll end up saving a lot of money over time. Using FIFO and the 4 weeks rule.

Well jump into the detail of each tax type a little further down. Check out this directory of tax professionals. Positively though these profits would be subject to tax at 125.

We verify each and every crypto tax accountant in our directory. MJ Support Co. If you feel a little lost and in need of professional help consider hiring a crypto tax accountant.

Form 1040 and all standard schedules Schedule A B and D. In Ireland crypto is typically taxed. Browse Koinlys directory of crypto and bitcoin tax accountants and CPAs.

4 Easy Steps To Prepare Your Cryptocurrency Taxes. Crypto tax accountants in Ireland. Certified Accountants And Business Consultants are specialised in providing advice in relation to crypto assets and gains advising on investingtrading and filing their personal or company tax returns.

The official Crypto Tax Accountant directory. Our Crypto Tax Reports are compliant with the regulation of each specific country and you can simply use the report to complete your own return or hand it to your local tax accountant. Suite 401 Coventry Chambers 1-3.

The guide provides our interpretation of the laws that we have built into the. CryptoTraderTax is now CoinLedger. Robin Singh is the co-founder and CEO of Koinlyio a cryptocurrency tax platform that automatically generates capital gains reports for Ireland UK USA other countries.

Your chargeable gain is therefore 3000 - 1000 2000. Solves Crypto Tax Specialist is a Chartered Accountant with 12 years experience in Big 4 tax consulting who advises crypto investors traders and businesses using Koinly. United Kingdom United States of America Japan Australia Switzerland Spain Ireland France Norway and Germany.

27 January 2020 Jamie McCormick. In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares. Ireland accounting firm with experience in crypto taxation.

We specialize in tax compliance for crypto investors. If you dabbled in the crypto market in 2020-2021 then you will likely pay one or all of these taxes depending on the type of activity you were involved in. In summary Revenue have taken the stance that no unique tax rules are required for crypto assets - as such the taxation of income or gains arising from crypto assets is subject to Irelands existing tax principles on a case-by-case basis - namely Capital Gains Tax CGT IncomeCorporation Tax VAT PAYE and Stamp Duty.

We understand Crypto and DeFi income. If you are an Irish citizen you will need to file your capital gains from crypto trading on a Capital Gains Tax form for both the Initial and Later periods. Find a certified tax professional specializing in cryptocurrency taxes to help with your declarations.

Receiving income or gains from an Initial Coin Offering ICO investment. We verify each and every crypto tax accountant in our directory. Ireland accounting firm with experience in crypto taxation.

Crypto Accountants in Ireland. Richard Lalor is the Principal of Lalor and Company Richard is a qualified Chartered Accountant CAI a Chartered Tax Advisor and a Cryptocurrency enthusiast. Our technology team can give you expert guidance whether you are.

We only list CPAs crypto accountants and attorneys. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. At Moore we are at the forefront of professional advisers in our understanding of this rapidly emerging sector.

As cryptocurrency becomes increasingly more mainstream even if it still remains a niche among Irish users the Chartered Accountants Ireland have posted an interesting update to their coursework for receiving their accreditation. Irish citizens have to report their capital gains from cryptocurrencies. Capital gains tax CGT form.

We were one of the first firms to offer cryptocurrency tax preparation. Whether you are a casual investor a day trader a miner or have a crypto-related business we have done it all. Liam Burns is the Principal of Liam Burns and Co - Accountants and Tax Advisers in Dublin 3.

This means that profits from crypto transactions are subject to capital gains tax at. Robin Singh is the founder of Koinlyio a cryptocurrency tax solution that automatically generates capital gains reports for UK and Ireland. Are you in need of a tax professional who specializes in bitcoin and cryptocurrencies.

97 Malahide Road Clontarf Dublin 3 Ireland. Capital gains tax report. Which is why he has established a transparent pricing structure that will.

Established in the early 1990s we have over. Maxwell Associates is an award-winning tax and business advisory firm. You then deduct your personal exemption to find your taxable gain which is 2000 - 1270 730.

CryptoTaxCalculator is an online tax tool to help users organise and convert transactions to make the tax process easier. With the standard CGT rate of 33 the amount of tax you will have to pay will be 730. CAT is currently 33 to the value of the crypto-asset on the valuation date subject to reliefs.

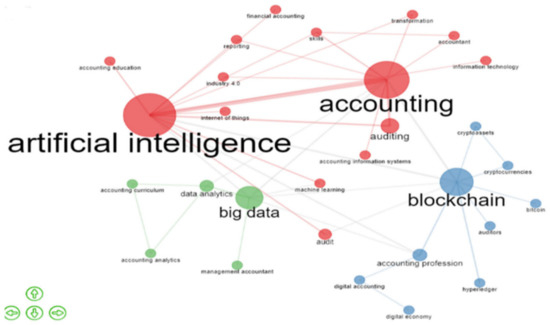

Applied Sciences Free Full Text Digitization Of Accounting The Premise Of The Paradigm Shift Of Role Of The Professional Accountant Html

Hedera Hasgraph Launches Early Access For Secure And Fast Blockchain Alternative Blockchain Fintech Hedera

Gahan Co Cryptocurrency Accountant In Ireland Koinly

Chartered Accountant Tax Advisor Adrian Markey Chartered Accountant

Malone Co Cryptocurrency Accountant In Ireland Koinly

These Five Countries Are Conduits For The World S Biggest Tax Havens Tax Haven World S Biggest Rich Country

Itas Accounting Cryptocurrency Accountant In Ireland Koinly

Cryptocurrency Tax Accountants Koinly

Cryptocurrency Accounting The Beginner S Guide Koinly

Cryptocurrency Tax Accountants Koinly

Level Up Your Freelance Finances With These Expert Tips Finance Freelance Financial Tips

How To Create Conditions For Strong Controls In Your Business Scg Chartered Accountant Chartered Accountant Internet Security Business

Lalor Company Cryptocurrency Tax Services In Ireland Lalor And Company

Galaxy Digital Raises 500 Million For Business Expansion Business Expansion How To Get Rich Vietnam

Cryptocurrency Tax Accountants Koinly

Lalor Company Cryptocurrency Tax Services In Ireland Lalor And Company

Galaxy Digital Raises 500 Million For Business Expansion Business Expansion How To Get Rich Vietnam